The purpose and positive effect of the EU Taxonomy

Investors are increasingly allocating capital to sustainability-related investments. As the ESG market grows, investors request standardization, comparability and transparency increases. The EU Taxonomy enables the allocation of capital to support the transition to a low-carbon, resilient and resource efficient economy over time. Overall, it provides a “gold standard” for the classification of environmentally sustainable economic activities and should therefore also reduce the risk greenwashing.

EU Taxonomy at Catella

As a publicly listed company that falls under the NFRD the EU Taxonomy Regulation also applies to Catella. We considered the regulation to be directly applicable to Catella Principal Investments and therefore decided to prepare a report on EU Taxonomy-alignment for 2022.

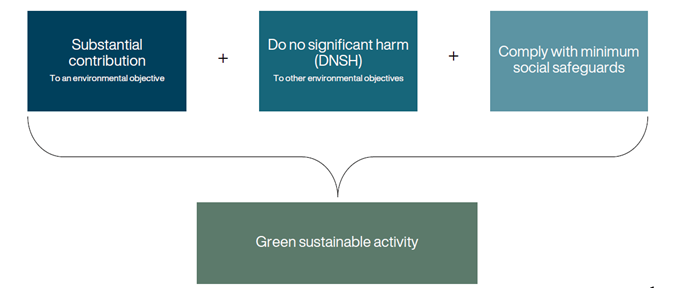

The EU Taxonomy lists technical screening criteria for each of the eligible activities. If an activity meets all the technical screening criteria for ‘substantial contribution’ and ‘do no significant harm’ (DNSH), and if the minimum social safeguards are complied with at company-level, the eligible activity can be considered aligned.

Minimum social safeguards

As part of ensuring compliance with minimum social safeguards in accordance with the EU Taxonomy, Catella must ensure that we do not harm or violate any laws or regulations concerning:

- Human Rights

- Corruption

- Taxation

- Fair competition

During 2022 we screened our policies and processes in relation to the above four aspects and concluded that we are compliant with the safeguards governance requirements.

Corruption

Catella has anti-corruption processes in place through its robust and recently updated governance framework as well as the independent external whistleblower system. We have no reported or confirmed convictions of violation of corruption.

Taxation

Catella treats tax governance and compliance as important elements of oversight. We have clear processes and instructions for taxation in our financial handbook, and external auditors are used for review. As a company listed on the Nasdaq Stock Market, Catella follows all applicable laws and regulations. Catella has tax risk management strategies and tax processes in place and described in our financial handbook. Each year a self-assessment process is sent out by Catella AB to all entities, and the answers are validated by external auditors. The auditor reports back to the entity as well as to Catella AB and the Board of Directors. The local CEO/MD is responsible for ensuring that tax laws and obligations are fulfilled. Catella has no affirmed convictions of violating tax laws. External auditors are obliged to report tax breaches to relevant local authorities if irregularities or breaches are found.

Fair competition

Catella ensures that employees are aware of the importance of compliance with applicable competition laws and regulations, by ensuring that all employees read, understand, and sign our Code of Conduct. Catella has no affirmed breaches of competition laws.

Human Rights

As stipulated in our Code of Conduct we are committed to respecting and supporting several international declarations on human and labour rights including the United Nations Universal Declaration of Human Rights, the Fundamental Conventions of the International Labour Organisation (ILO). We are committed to ensuring that policies and processes follow the UN Guiding Principles on Business and Human Rights, the UN Principles on Responsible Investments (UNPRI), the OECD Guidelines for Multinational Enterprises and the UN Global Compact. As part of our overarching work on minimum social safeguards we conducted a Human Rights Impact Assessment (HRIA) in the autumn of 2022, which will serve as foundation of our Human Rights Due Diligence (HRDD) going forward. To meet our commitment to respect human rights, we have developed and integrated an ongoing human rights due diligence process. The findings show that we have relevant processes in place but need to further systematise our human rights processes and embed them throughout the organisation.

In line with our commitment to responsible business practices, we have also introduced a Supplier Code of Conduct, which sets clear expectations for all new suppliers regarding labour practices, human rights, environmental impact, and business integrity. This initiative ensures that our values and sustainability goals are reflected throughout our supply chain. All new suppliers are required to acknowledge and comply with the Code as part of our onboarding process, reinforcing our ESG principles across the entire value chain.

Substantial contribution and do no significant harm

The activities that were identified as relevant and directly applicable to the property projects within Principal Investments were, 7.1 construction of new building, and 7.7 acquisition and ownership of buildings, which then were assessed for ‘substantial contribution’ and ‘do no significant harm’ criteria. Even though several of the projects in Principal Investments have made significant efforts to integrate environmentally sustainable solutions into the building design and construction, none of the buildings succeeded in meeting the full EU Taxonomy criteria, which means that we have no EU Taxonomy alignment for 2022. Please see the relevant tables on CapEx, OpEx and Revenue in the Catella Annual Report 2022. One reason for this is that the technical screening criteria for climate change mitigation and climate change adaptation were not considered from the start/from the planning phase of the project (since it was published and adopted by the EU Commission in April 2021).

Conclusion

However, the EU Taxonomy-assessment will be used as a learning experience and stepping-stone for the property projects in Principal Investments. Catella Principal Investments is now able to use the assessment as a gap analysis and plan actions to reach EU Taxonomy alignment. It provides the team with a roadmap setting out the actions required in order for each building to become aligned in the upcoming years. The assessment also provided us with a comprehensive tool to become familiarised with the EU Taxonomy requirements and incorporate them into future projects at an earlier stage. We will continue to evaluate and monitor the EU taxonomy going forward.