From a Mitigation World to an Adaptation World

The Epsilon, or Greek letter ‘E’-shaped trifurcation of real estate investment portfolio valuations along alternative pathways from a decarbonisation ‘tipping point’ was introduced in: ‘The Epsilon Great Transformation of Real Estate Markets’ in our European Residential Vision report 2023, which aimed to conceptualize the integration of climate change mitigation into investment strategies.

These ideas formed Catella’s contribution to the Urban Land Institute-led ‘C Change’ programme that supports the development of a common industry methodology to assess climate mitigation risks as part of property valuations to avoid the stagnation of real estate investment markets and avoid stranded assets. C Change is consequently also the industry’s most advanced ‘North Star’ for navigating the mispricing challenges to investors presented by climate change.

In this year’s European Residential Vision, we dive deeper into how the sustainable decarbonisation financial mechanism works and address the likely further Epsilon segmentation of real investment markets (Epsilon II) as we fail to adopt climate mitigation decarbonisation strategies fast enough, which brings us into the ‘Adaptation World’ and another mispricing of assets.

Adaptation risks are not properly priced in currently and so new market tipping points will arrive, which will signal a further differentiation in valuations between assets with Adaptation premia and adaptation write-offs. Some regions are more adaptive resilient due to their natural endowments, political systems, energy consumption patterns and limited complexity density. Some assets are also adaptive beyond their current usage because they repurpose at extremely low cost and CO2 levels and can deal with migration flows arising from the expected radical changes in the physical environment.

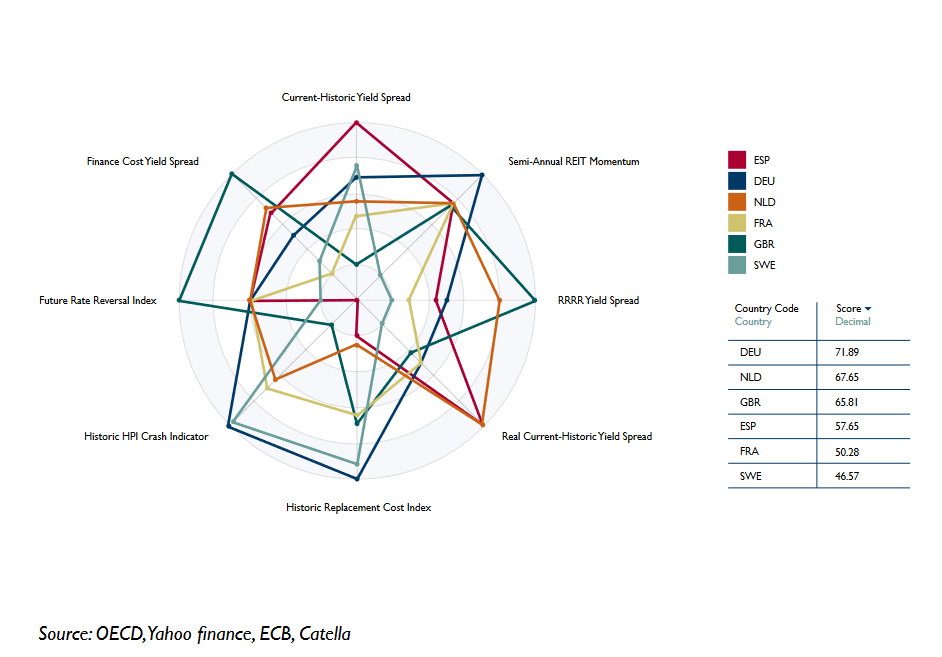

Our analysis primarily examines the future of environmental and market shifts from a long-term perspective. To complement this, we've introduced a macroeconomic dashboard designed to assess the fair pricing in the current residential real estate markets. This integration of real-time economic insights with our long-term environmental strategies offers a comprehensive view, ensuring informed investment decisions that balance immediate market conditions with future projections.

- The European economic environment is changing at an unfamiliarly rapid pace, which is greatly complicating real estate investment pricing and timing.

- To assess fair pricing from a general perspective, we developed a macroeconomic dashboard that summarizes a set of indicators relevant for investment decisions.

- To determine the right time for a property investment, we have developed a probabilistic tipping point model that provides information about the position of a market in the real estate cycle.

- The analysis highlights Germany as the most favourable investment environment but notes that even here, fair pricing has not (yet) been achieved.

- Southern European countries have not yet experienced a recent downturn in their housing markets. Based on the indicators of the dashboard, in particular the development of construction costs, house prices could be above a market equilibrium, which indicates a possible future downturn.

- The tipping point model suggests that Germany’s residential market enters a moderate recovery, potentially starting in the second quarter and continuing for the rest of the year.

Macro Dashboard results