There is hardly a survey among corporates on the market-changing topics of the future in which the topic of ESG is not placed among the TOP 3 - no matter in which country we are in Europe. Working groups that explore standards and market practices are springing up everywhere. Especially the aspect of capital flow into real estate vehicles or assets is of great interest here.

Clearly, the disruptive megatrend ESG has become an integral part of the economy as we know it today. Especially for the real estate industry, as one of the main CO2 emitters, sustainable management is no longer a "competitive factor" per se, it has become strategically vital for survival. Reason enough for us to take a look at the current dynamics in the green financial market, where money flows into ESG funds and the issuance of sustainability bonds (green, social and sustainable) continue unabated. This dynamic development will continue for companies as governments, supranational institutions and various stakeholders further intensify their focus on climate change and reducing carbon emissions.

Did you know that,

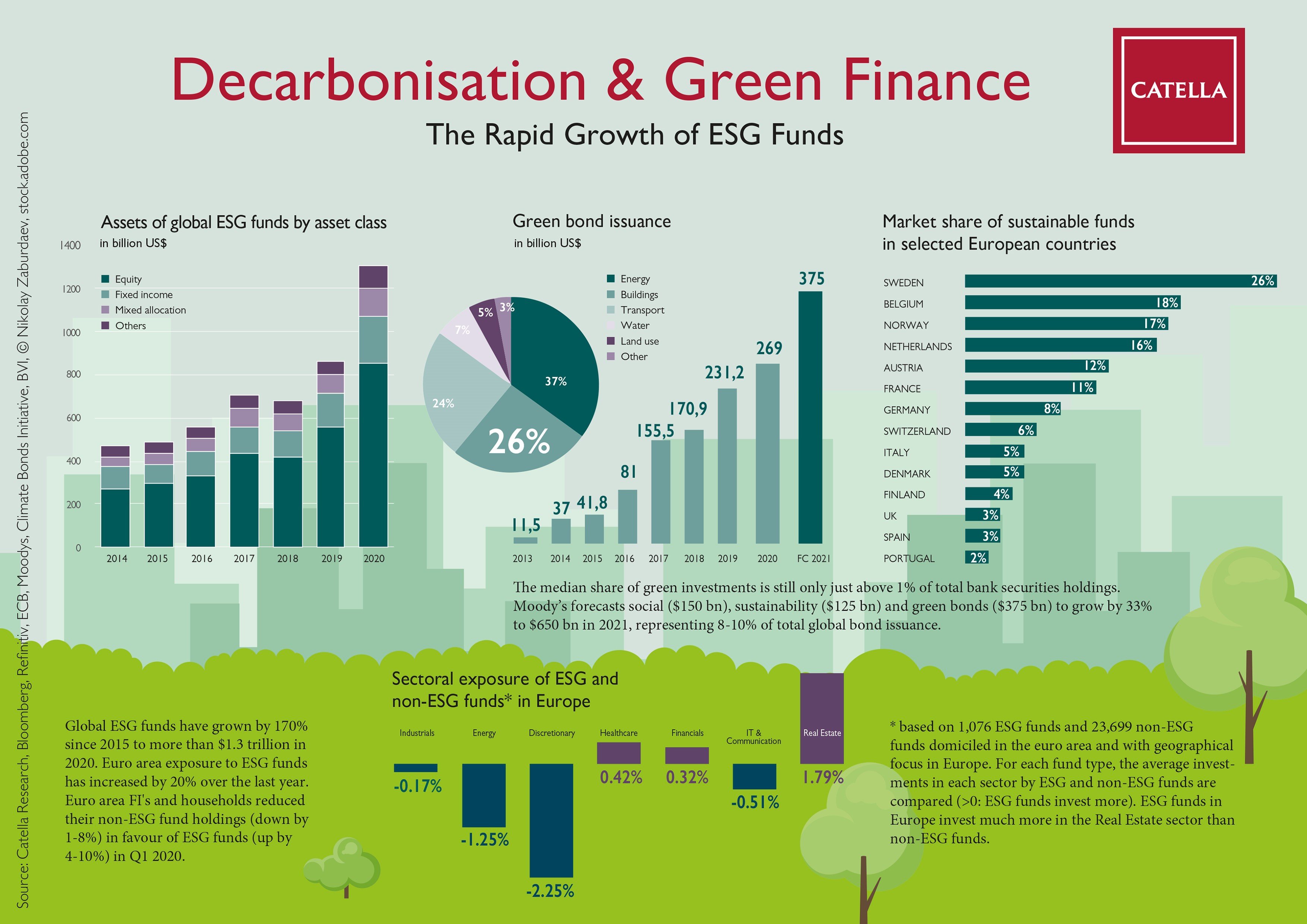

- ESG bond & equity funds have grown globally by 170% since 2015 to more than $1.3 trillion in 2020?

- the aggregate exposure of euro area sectors to ESG funds has increased by 20% over the last year?

- ESG funds have proved more resilient than their non-ESG peers with cumulative inflows of around 15-20% since the turmoil in March and issuers increasingly pursue debt financing for environmentally friendly projects?

- households and insurance corporations and pension funds (ICPFs) hold over 60% of euro area ESG funds?

- euro area investors now hold €197 billion of euro area green bonds

- new green bond issuance accounted for 13% of total euro area bank bond issuance in Q3 2020, up from just 4% in the first quarter of 2020

- in Q1 2020, euro area FIs and HHs reduced their non-ESG fund holdings (down by 1-8%) in favour of ESG funds (up by 4-10%)?

- the median share of green investments is still only just above 1% of total bank securities holdings?

- the country with the highest share of sustainable funds is Sweden with 26%, followed by Belgium (18%), Norway (17%) and the Netherlands (16%)?

- social ($150 bn), sustainability ($125 bn) and green bonds ($375 bn) are forecasted by Moody’s to grow by 33% to $650 bn in 2021, representing 8-10% of total global bond issuance after accounting for 5.5% of total issuance in 2020?

- this represents a 39% jump of green bond issuance this year, a 6% rise of social bonds, after increasing sevenfold in 2020, while sustainability bonds would grow 58% after doubling in 2020?

Sustainability as a performance criterion is becoming increasingly decisive in the real estate industry, not least because financing and thus borrowing costs are becoming comparatively cheaper and easier for green companies. Many are talking about it, but the practice is only just developing a foundation. The majority of loans are not yet green loans in the true sense of the word. However, measurable success at the capital market level will come much faster than we can expect at the property level.

Download Infographic Decarbonisation & Green Finance