Munich, 03.11.2022 - Even the logistics asset class, which has performed above average in recent years, is feeling the effects of volatile capital market movements. Risk premiums in financing, increased taxonomy compliant ESG questions in project development, but also an increasing look to the east with new projects along the eastern border in Europe can be observed.

The changed financing conditions for project developments in this segment, which have been measurable for 9 months now, and the fundamental risk adjustment to the political-economic situation will put further pressure on multipliers or yields. The overall weakening economic situation in Europe will also have an impact. Nevertheless, the demand for logistics real estate continues to be offset by a very low supply.

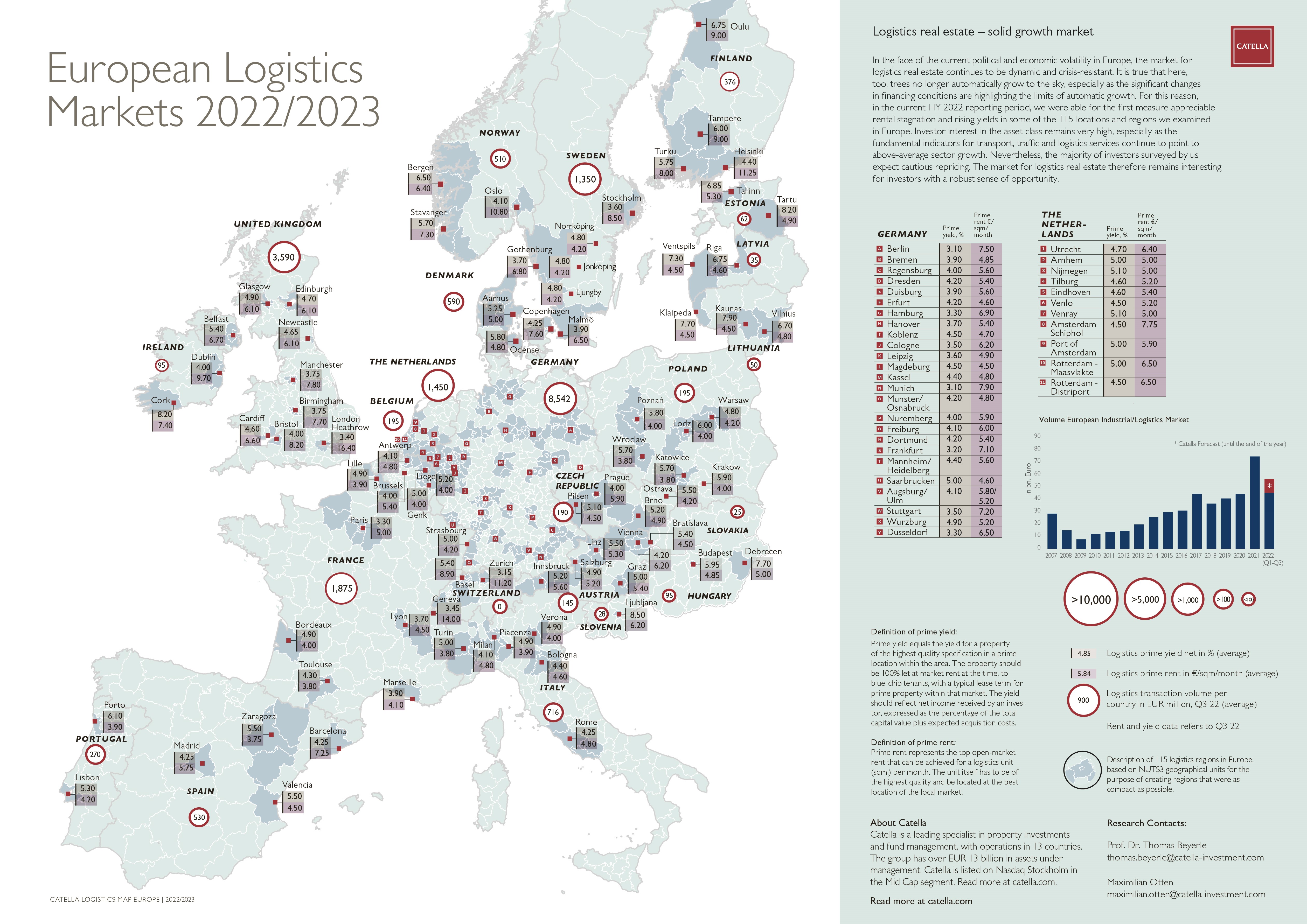

There have been changes in yields and rents over the past 6 months. Our forecast from spring 2022 that "we will find a new yield landscape in parts of Europe" has come true. Currently, we would like to give you an overview of Q3 2022 and the expectations for the logistics markets in Europe - as always in a comparative overview, with a total of 115 regions.

- European prime rents currently average €5.84/m² and range from €3.75/m² in Zaragoza to €16.40/m² in London. Since our last market survey in March 2022, prime rents for logistics properties have risen by an average of over 1.5% across all 115 markets surveyed.

- The increase was particularly significant in Rotterdam-Maasvlakte (+44%), Antwerp (+17%) and Brussels (+10.20%).

- Due to the new risk assessment on the European commercial real estate markets, the yield compression of recent years has come to an end. However, it has changed slightly. European prime yields now average 4.85%, which is only 3 basis points higher than when analyzed 6 months ago.

- The lowest net initial yields, indicative of the most expensive logistics locations in Europe, are found in German A-locations (3.10% in Berlin & Munich, Paris (3.30%) and London (3.40%). No location in Europe has fallen below the 3% mark and will continue to do so for the foreseeable future.

- The continued strong demand for logistics properties is also reflected in the transaction volume within the individual countries. For example, a logistics transaction volume of €8.5 billion was recorded in Germany and €3.5 billion in the UK. Overall, across the markets surveyed, an investment volume of almost €21 billion was achieved in Q3 2022, which - after the record figure in 2021 - represents the second-highest transaction volume ever measured. Our forecast for 2022 is a transaction volume of €59 billion.

In the overall view, there continues to be an impressive market constitution in Europe. Nevertheless, the logistics real estate market will face reshoring, nearshoring, and effects of the war in Ukraine in the coming months. Growth will remain with increased risk provisioning on the part of investors.

Sincerely yours,

Prof. Dr. Thomas Beyerle

Download Logistics Map 2022 / 2023