There is no question that the mood on the European real estate markets is not only gloomy, but is also measurably reflected in the declining transaction volume in the second quarter of 2022.

The reasons are well known and have come in spurts since November 2021:

- Pandemic ("only occasionally priced into the real estate markets")

- Inflation ("unimaginably high")

- War in Ukraine ("system shock")

- Interest rate adjustment ("rather symbolic, but heralds market turnaround")

But that's not enough, the "R" word is doing the rounds again, the first economists consider "at least" a technical recession conceivable for the autumn.

As is almost usual, both positive and negative messages shoot up to interesting heights, especially at the beginning of a crisis. Here the pessimistic approach, which sees the "double trouble" as a signal for a strong market correction, there the optimist, who points to the autumn, when "they will all come back".

Where does the truth lie in these forecasts? Probably in the middle, because it is clear that only a few are currently buying, but rather waiting for prices to fall. This certainly explains the decline in transaction volume. Potential sellers are also not entering the market at the moment, as the (old) price level does not seem attainable at the moment and people are still hoping for an improvement. The next expected ECB steps are "anticipated" and priced in.

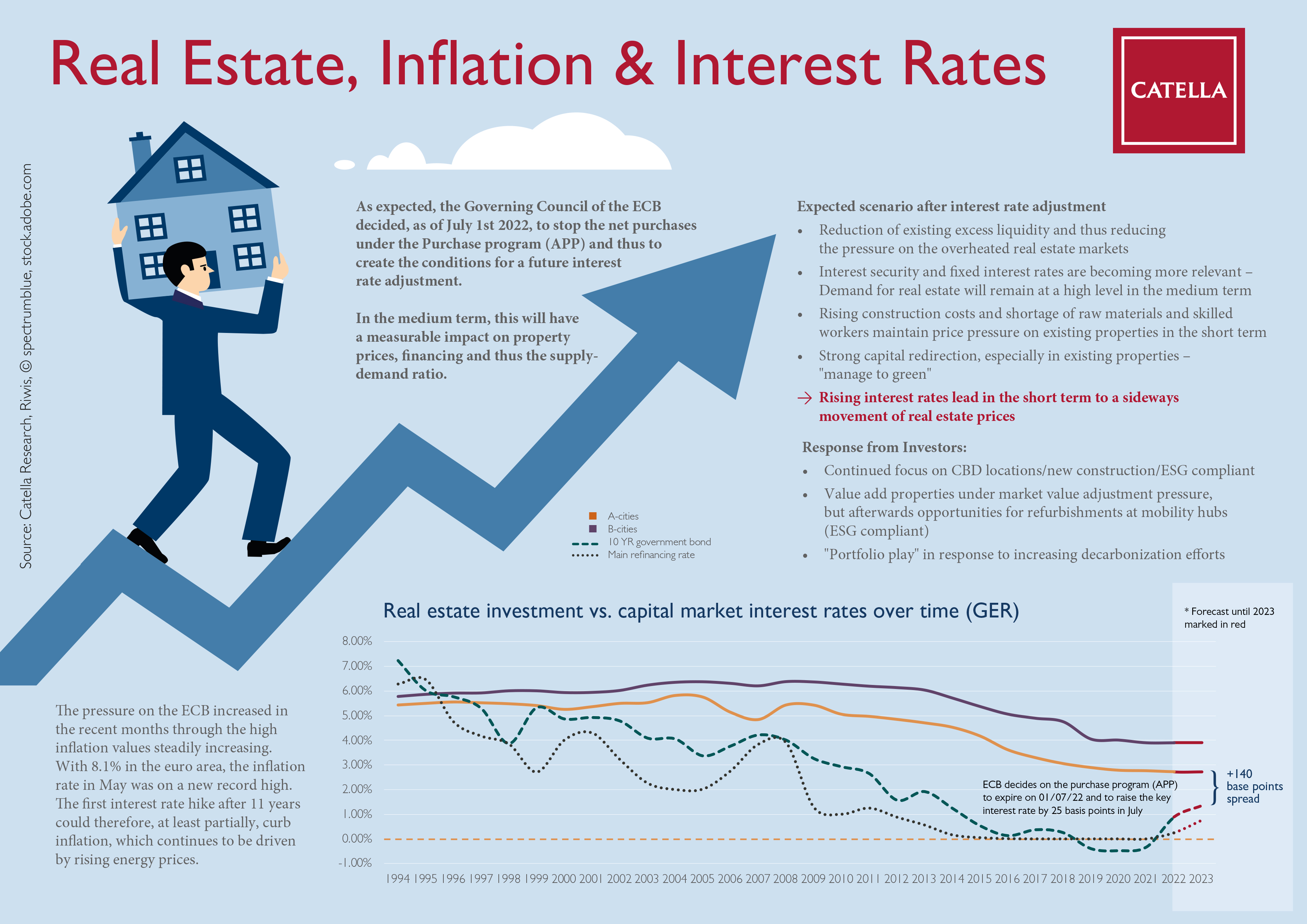

We are of the opinion that a rising interest rate level in the coming months will rather lead to a sideways movement of real estate prices. What is clear, however, is that a re-sorting of prices will generally take several months.

What makes the whole thing challenging, moreover, is that little sound calculation can be made at present, which is why major decisions tend to be (or should be) postponed. There will be some upheavals and quite a few losers "during the summer", but this can create interesting opportunities for well-funded players and suppliers of TOP products.

What we do know is the rational reaction of investors:

- The continued focus on CBD locations/new build/ESG compliant

- Value-add properties come under market value adjustment pressure, but then opportunities for refurbishments at mobility hubs (ESG-compliant)

- Portfolio play" begins in response to increasing decarbonisation efforts

But despite all the current unrest, we should not ignore the fact that the strong redirection of capital, especially into existing properties - "manage to green" - will continue. This will then result in the greatest opportunities in the coming quarters - regardless of the investors' risk level.

As you can see, these are currently moods, initial figures, but at least a new infographic that shows these correlations.

Download Catella Infographic Real Estate, Inflation & Interest Rates