Retail is suffering across Europe! No, especially as generalized statements indicate a general trend, but a more in-depth market analysis reveals major differences within the EU member states and the UK. The fact is that there are many solutions in the largest retail sub-segment, shopping centers, to "return to pre-pandemic figures". However, this is where the first error in thinking lies: it was already foreseeable in the middle of the last decade that the times of steadily rising transaction volumes and increasing customer frequency had reached their peak - on a European average, mind you. There was hope immediately after the pandemic. However, this turned out to be a classic catch-up effect - in combination with the turnaround in interest rates, the war and consumer restraint.

Online shopping is here to stay and the expected growth rates in most European countries remain impressive. Consistently strong growth is attributed to the grocery sector in particular. This is understandable, as it has come through the pandemic crisis largely unscathed. Systemically relevant is the term often used here. This appreciation among investors was reflected in multiples of up to 30 times until 2022. At the beginning of 2024, they levelled off again at a level of 20 times.

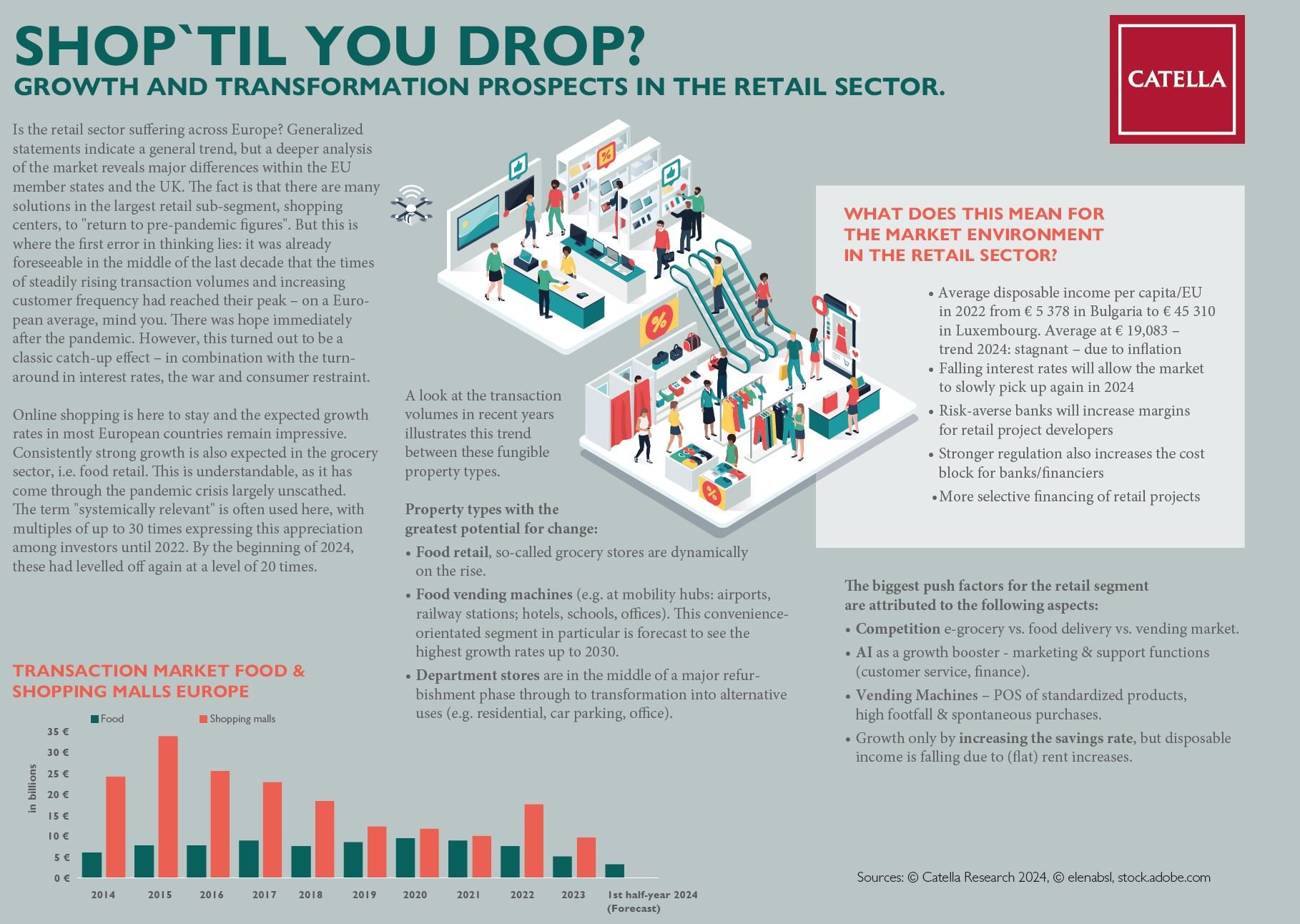

A look at the transaction volumes in recent years illustrates the trend between these fungible property types.

We see the following property types with the greatest potential for change within the retail sector:

- Food retail, so-called grocery stores are dynamically on the rise.

- Food vending machines (e.g. at mobility hubs: airports, railway stations; hotels, schools, offices). The highest growth rates up to 2030 are forecast in this convenience-orientated segment in particular.

- Department stores are in the midst of a major refurbishment phase through to transformation into alternative uses (e.g. residential, car parks, offices).

Analyzed analytically and soberly, we currently see a slight change in sentiment towards the positive, especially in the "food retail" sub-segment. Falling interest rates will allow the market to slowly pick up again in 2024. This means that risk-averse banks will also increase margins for retail project developers and more selective financing of retail projects can be expected in the coming quarters.

Enjoy the infographic and have fun with the Easter egg hunt!

DOWNLOAD CATELLA INFOGRAPHIC