22 May 2023 - In the major European cities, a very high demand for residential space continues to be observed even in the general market turnaround phase. This demand effect, caused by continuing urbanisation processes, in combination with a limited supply of living space, means that residential rents continue to show upward trends.

In contrast to the rental market, the situation on the European transaction market for residential real estate must be reassessed. The momentum of recent years, stimulated by the low interest rate policy, was primarily halted by the turnaround in interest rate policy. As a result, it can be observed that by the end of 2022, transaction volumes had fallen sharply in numerous submarkets of the European residential real estate markets. This development continued in the first quarter of 2023. An end to this trend reversal is currently not foreseeable. We expect the general conditions on the European transaction markets for residential real estate to remain tense for the rest of 2023. In addition, low-risk fixed-interest investment opportunities are increasingly coming into focus as an alternative investment on the capital markets due to the rise in interest rates.

This combination of a continued positive rental trend and a decline in demand on the transaction market means that rising yields can currently be reported on almost all major European residential property markets.

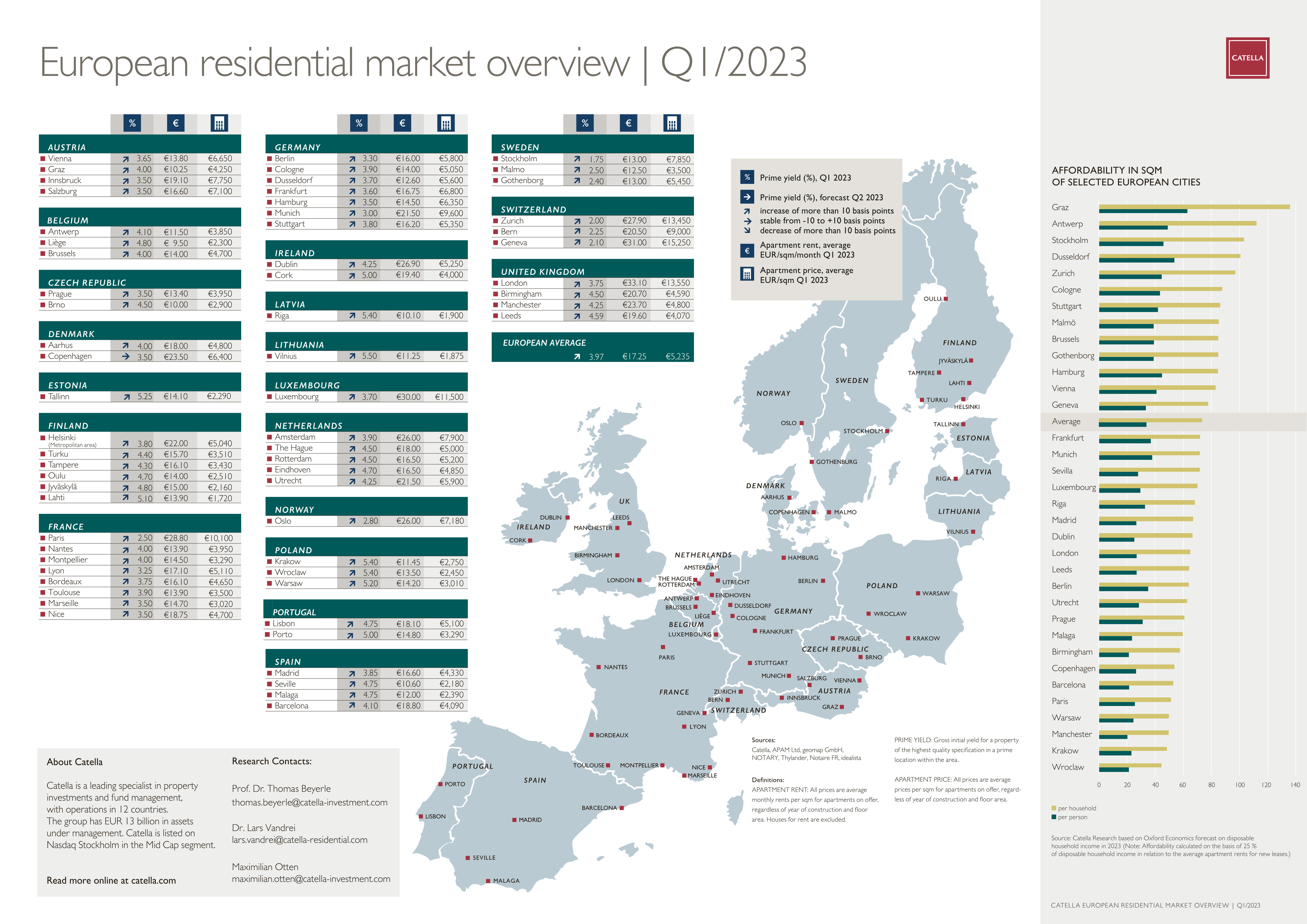

Catella Research has once again analysed the residential property market of 63 cities in 20 European countries.

Here are the key findings of our analysis:

- The average residential rent (all years of construction) in our 63 cities analysed is currently EUR 17.25 per m².

- The cheapest rents are found in Liège (EUR 9.50 per m²), followed by the city of Brno with an average of EUR 10.00 per m².

- On average, prospective tenants face the highest prices in London (EUR 33.10 per m²), Geneva (EUR 31.00 per m²) and Luxembourg (EUR 30.00 per m²). Only Amsterdam, Dublin, Oslo, Paris and Zurich still reach the mark of at least EUR 25.00 per m².

- The average purchase price for a condominium in Europe (all construction years) is currently EUR 5,235 per m². Prices range from EUR 1,720 per m² in Lahti to EUR 15,250 per m² in Geneva.

- The average European prime yield for multi-family houses is currently 3.97%. Compared to our last analysis in Q3 2022, the average prime yield has thus increased by 37 basis points in 6 months.

- The lowest yield of all European residential markets is found in Stockholm at 1.75%, followed by Zurich at 2.00%.

- The most attractive yields of the 63 markets surveyed are in the cities of Vilnius (5.50%), Riga (5.40%), Krakow (5.40%) and Wroclaw (5.40%).

In addition to the key figures on the housing markets, housing costs, i.e. the monthly financial burden on households, are increasingly attracting the attention of the public, associations and politicians. If one assumes a share of 25 % of the net household income spent on cold rent as the limit for affordability, the average household in Wroclaw with an income of EUR 28,860 per year would be able to afford just 44.5 m² at the current rents of EUR 13.50 per m². With an average household size of 2.1 persons, this corresponds to 21.3 m² per person. In mathematical terms, households in Graz can afford by far the largest flats - 135.9 m² on average. The average across the cities considered is 73.4 m² per household or 33.9 m² per person.

DOWNLOAD CATELLA RESIDENTIAL MAP