If you look around the European cities now, you experience a liveliness that we have rarely seen in the past two Corona years. Sure, catch-up effects can certainly be diagnosed, and the warmer season will do the rest. However, this “meet & greet” is superimposed by a socio-demographic development that has prevailed in the last 15 years. We are talking about the almost exploding number of so-called "single-person households" in urban centres. The average values here are significantly more than 50% (in comparison: At country level in the EU, these come to around 38%).

What is clear is that in recent decades the profile of the EU's population has changed, in part due to an aging society, changing patterns of family formation and structures, and shifts in the roles of men and women.

The fact that this development is also reflected in the real estate industry is shown by the building permits in the residential segment, especially in urban quarters and the establishment of an independent sub-market called "micro-living". And this is extremely lucrative for investors. Low land use, high sqm yield and continued growth forecast.

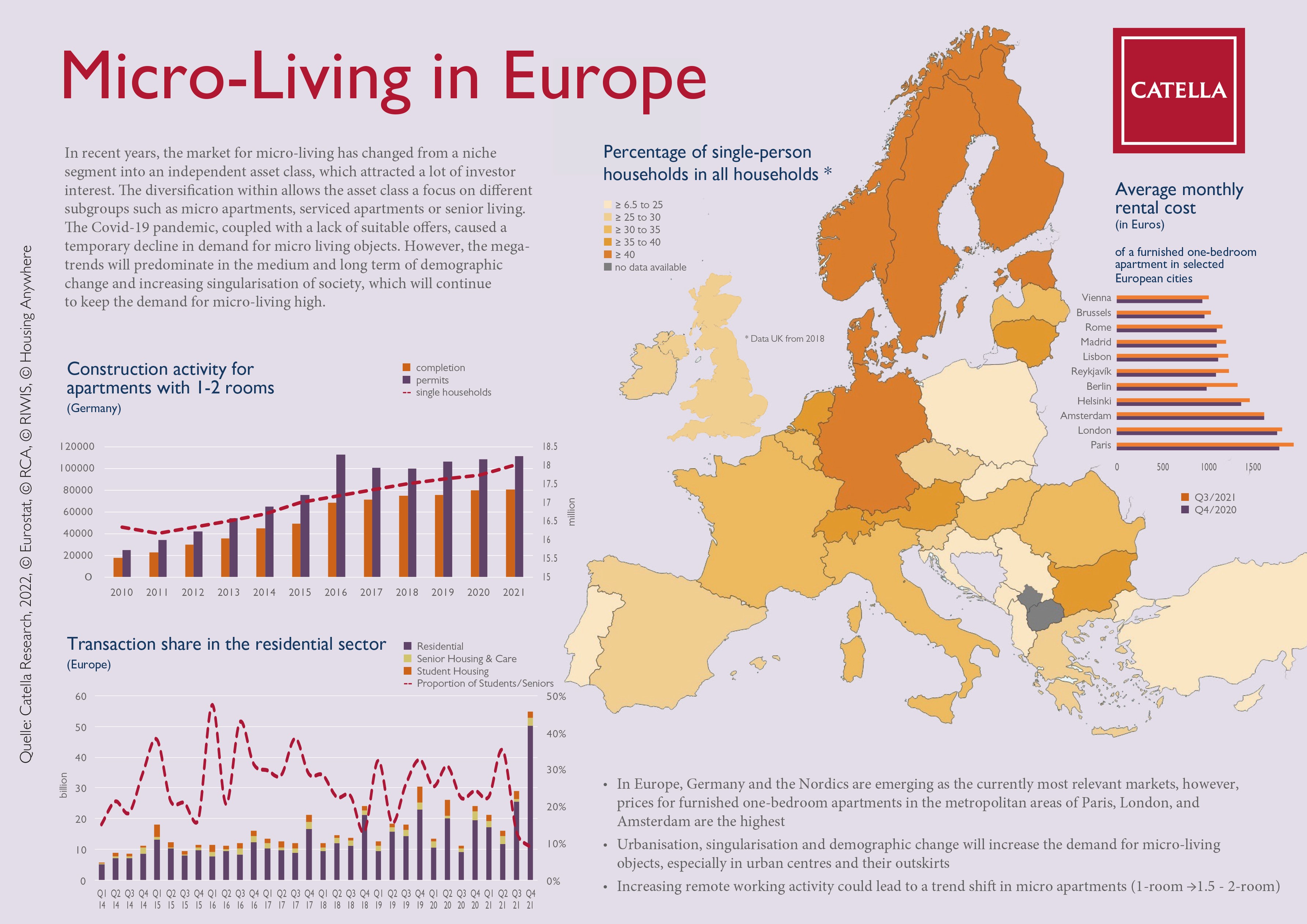

In recent years, the market for micro-living has developed from a niche segment into an independent asset class. The diversification within the asset class allows a focus on different subgroups such as micro apartments, serviced apartments, or senior living. Although the Covid-19 pandemic, coupled with a lack of suitable offers, caused a temporary decline in demand for micro-living objects, the megatrends of demographic change and an increasing singularisation of society will prevail in the medium and long term, which will continue to uphold for micro-living.

For investors:

- In Europe, Germany and the Nordics are emerging as the currently most relevant markets. In relative terms, the prices for furnished one-room apartments are highest in the metropolises of Paris, London, and Amsterdam.

- Urbanisation, singularisation and demographic change will continue to dynamise the need for micro-living objects, especially in urban centres and their outskirts.

- The increasing remote working activities could nevertheless lead to a trend shift in micro apartments, here the demands of the capital market from 1 room to 1.5 - 2 rooms will be heard more clearly.

It is also important to emphasise that the market will continue to become more dynamic in the coming years but will also differentiate. And of course, also in the sober numerical analysis: residents of micro apartments are statistically "one person households" and not necessarily "single households" (socio typographically). This brings Tinder into the picture for our analysis, but we'll save that for the infographic on starting a family.

Download Catella Infographic Micro-Living (PDF)