Logistic markets are booming, without a question. But this is only the result of a transformation the world hasn’t seen for a long time. Supply chains are currently reorganising, shortage of products and raw materials continues to accelerate, we haven’t seen in Europe since the end of the Second World War – with effects on both sides, national economies and private households.

The fact that scarcity is first regulated by price may sound obvious and is visible in the price increases or supply problems of the last weeks between smartphones, Christmas roasts, e-cars, labour in construction, building sand, plaster, clay or wood.

When we hear the call from several European politicians to “bring production back” (reshoring) and remember some of the undergraduate economics lectures regarding “comparative cost advantages” (Ricardo) it should be clear that a decisive note is missing: “Everything will be more expensive”. To put it more simply: What we as companies and consumers have valued under the term globalisation over the past 40 years is likely to change. Or isn’t it?

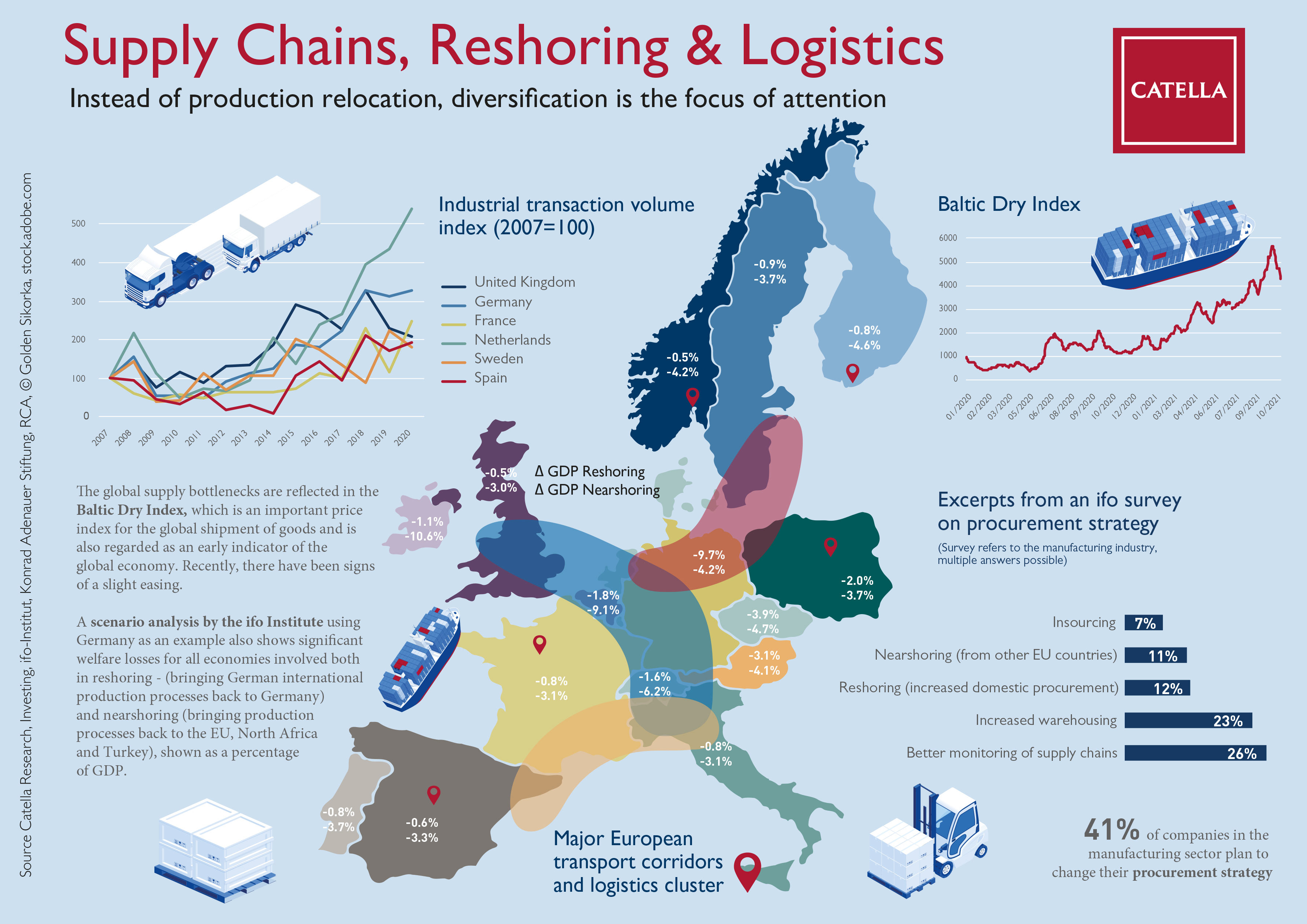

Currently the statements oscillate, whether and how international procurement strategies are changing and if there is a de-globalisation form of reshoring (bringing production back to the home country) or nearshoring (to the European hinterland) in order to consequently draw conclusions for the European logistics market.

In our latest infographic, we have taken a look at this phenomenon and prepared an overview of the tasks involved:

Did you know that,

- many manufacturing companies plan to change their global sourcing strategies (41%) and increase inventory levels (23%)?

- a better monitoring of supply chains in risk management is on the agenda (26%)?

- Attention: that near- (11%) and reshoring strategies (12%) appear to be of interest to only a few companies?

- a scenario analysis by the ifo Institute using Germany as an example shows that both reshoring and nearshoring will entail significant welfare losses for all economies involved, expressed as a percentage of GDP?

- almost self-evident: the European logistics markets can expect a record transaction volume of around €60 billion in 2021 (€43 billion in 2020)?

If we subject the statements to a sober analysis, we are certain that a major wave of relocating seems rather unlikely. Instead, companies are planning greater diversification in procurement and a broader selection of suppliers. For the European logistics market, this indicates a higher demand for warehouses overall, but also to high demand for cross docking and distribution centres within European logistics clusters and transport corridors. That would be a comparative cost advantage from the good old days, just a bit more national.

Download Infographic (PDF)