You may know this from various business meetings: The goal is clearly defined, but the path is diffuse – full of risks but with plenty of opportunities. On top of that: If you have no experience routines to fall back on, it becomes clear: Building certificates make only a very small contribution to this, as the real estate industry is now forced to admit.

At the latest at this point we notice that in the current hype around ESG & Co. the targets are defined very specifically (1.5-degree target), but after that on the European economic level of the EU taxonomy – to name only one relevant for real estate investors – the diffusion starts. This is followed by the EU Disclosure Regulation and EU Action Plan Sustainable Finance.

The whole thing is a challenge for us too, when you manage several pan-European real estate portfolios. The client has legitimate questions, as being a part of an evolutionary process of measurability between GRESB, INREV or Ecore ratings systems – which reporting requirements will establish themselves as market standard? Again, a dynamic process: NFRD (Non-Financial Reporting Directive) and CSRD (Corporate Sustainability Reporting Directive), which is expected to replace NFRD in 2023 – which will apply soon? Why not focus on the carbon footprint immediately, which makes objects comparable across countries? The respective national ESG requirements are of course fulfilled, but consolidation at the international level is more challenging.

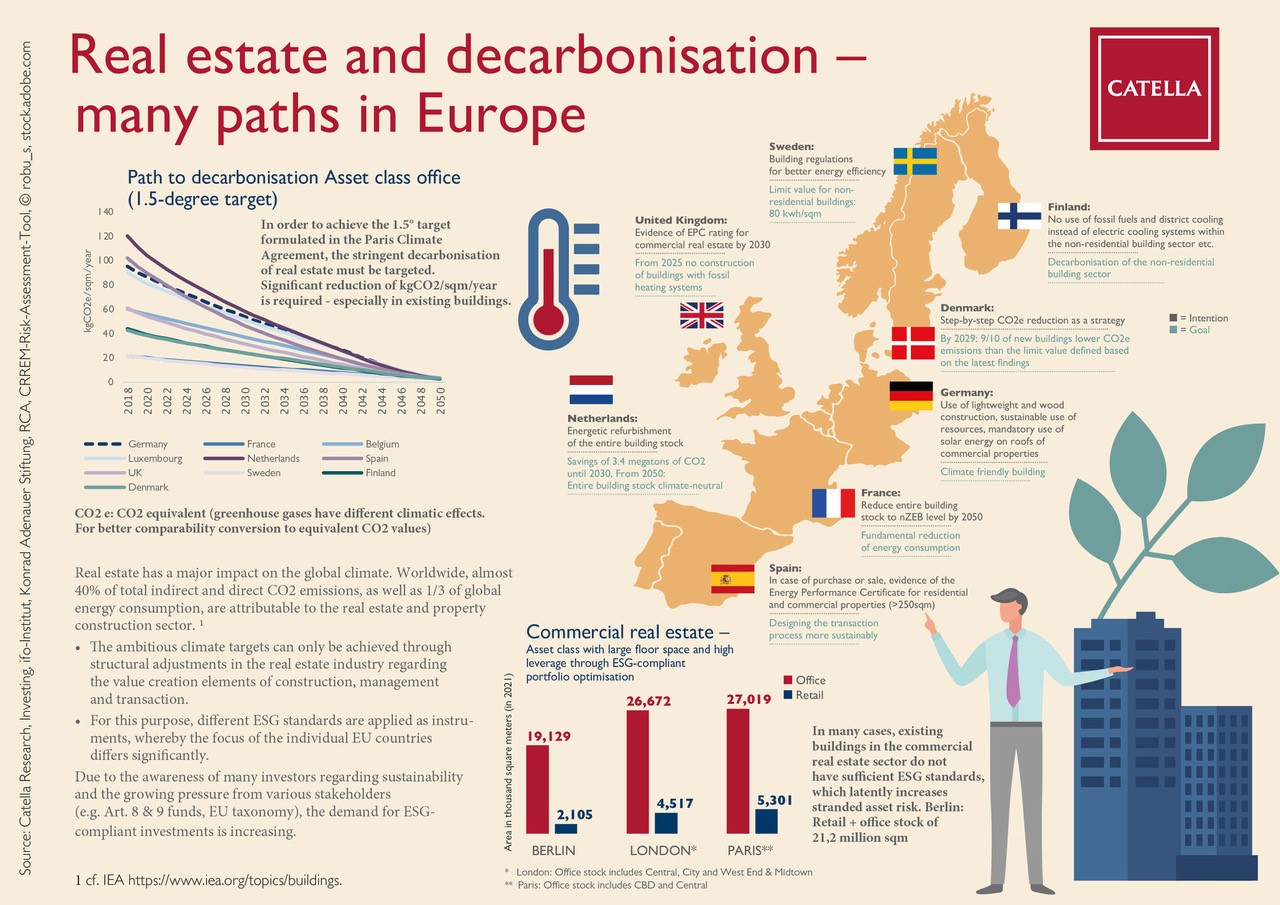

In our current infographic “Real estate and decarbonisation – many paths in Europe” we have therefore compared several country-specific paths and goals to illustrate this range of tensions by providing examples. In doing this, some aspects can be pointed out to advance the decarbonisation of the real estate industry.

- It is primarily a question of existing building stock, the new building stock already has a very high efficiency ratio.

- Market value adjustments will take place in the real estate market – Keyword: “Stranded Asset”-Risk

- Categorisation of regulated real estate funds will be completed the fastest.

You can see that the pressure is coming from various directions to decarbonise real estate, whether by law or by expectation from investors, to remain competitive as a company/fund. This is undoubtedly a good way to go, but it is primarily a process, and only then a product.

Download Catella Infografic: Real estate and decarbonisation (PDF)