The objective of Catella Hedgefond is to deliver stable returns at low risk, regardless of market conditions. The fund invests mainly in Nordic equities and bonds. It applies negative screening for sustainability criteria, and consequently entirely avoids long positions in companies that produce tobacco, alcohol, commercial games for money, pornography, coal, or weapons. Derivatives are used in the management to both protect its capital and increase opportunities for returns. The fund can be expected to have low covariance with performance in the equity, credit and bond markets, and may thus both raise the expected return and lower the expected risk in a traditional equity and fixed income portfolio.

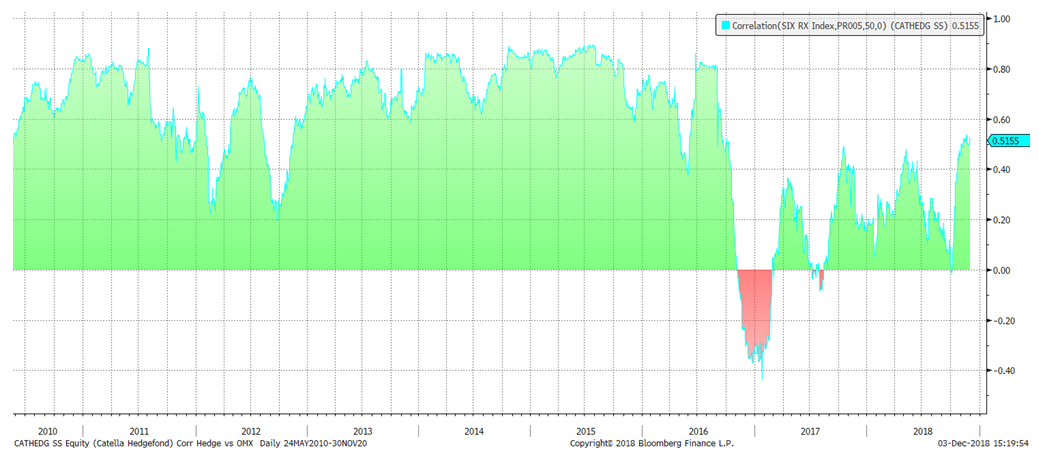

Figure 1. 50-day correlation between Catella Hedgefond and OMX

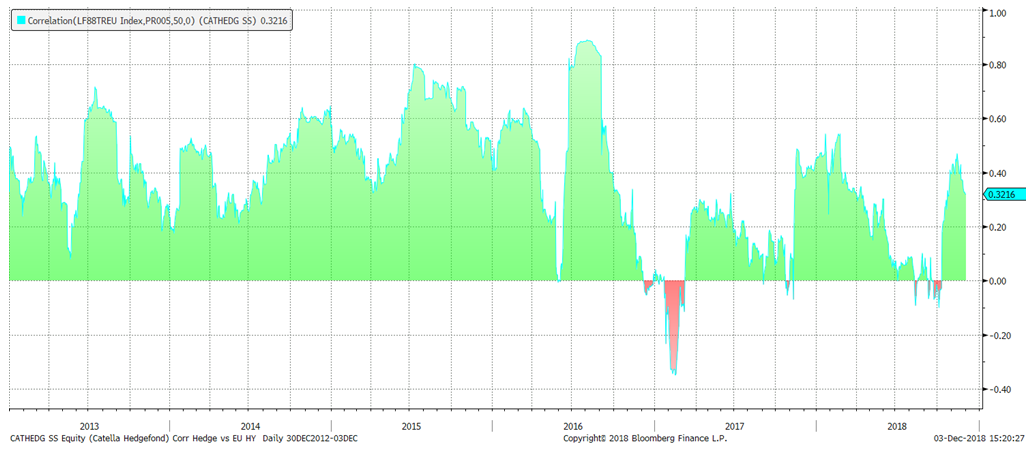

Figure 2. 50-day correlation between Catella Hedgefond and Barclays EU High Yield 3 % cap

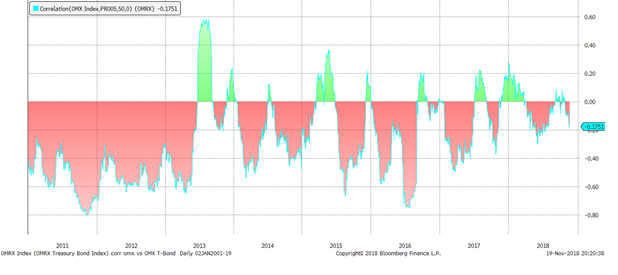

Figure 3. 50-day correlation between Catella Hedgefond and OMRX T-Bond

When structuring the portfolio, we place great emphasis on diversifying risk and ensuring that no individual holding or individual factor will have too much influence on fund performance.

| Five largest long equity positions as % of AuM | Five largest short equity positions as % of AuM | ||

| Share 1 | 1.66% | Share 1 | -1.15% |

| Share 2 | 1.54% | Share 2 | -1.01% |

| Share 3 | 1.49% | Share 3 | -0.88% |

| Share 4 | 1.40% | Share 4 | -0.76% |

| Share 5 | 0.94% | Share 5 | -0.69 |

| 7.03% | -4.49% |

Figure 4. The largest long and short positions in Catella Hedgefond

The investments are based on fundamental analysis of individual companies plus traditional macroeconomic analysis. The objective of the fund is to generate an annual return of 3-5 percent with a standard deviation of 3 percent.

The return this year

This year's return has been very disappointing. At November 19, Catella Hedgefond had fallen 1.82 percent. The performance of the fund depends partly on company-specific risk, in both individual stocks and bonds. Generating a target return of 3-5 percent in the prevailing market requires the fund, as a whole, to take risk, which means there is scope for outcomes on both the upside and the downside. Quite simply, our specific long company picks need to perform better than the stock market as a whole and our short picks need to perform worse than the market. Most of the returns in the fixed income portfolio come from higher risk bonds, known as high yield. The risk-free alternative yields a negative return these days.

There are a number of main explanations for this year's returns falling short of our target so far. For the fixed income portfolio, our view at the start of the year was that European central banks would follow the US Federal Reserve and begin ratcheting back their expansionary monetary policy. Less expansionary monetary policy would very likely mean higher interest rates, which was a position the fund held. Somewhat weaker growth expectations and, in particular, a lack of more intense inflationary pressure have pushed interest rate rises into the future, which had a negative impact on fund returns. Our short interest-rate position has been closed at a loss. Given the absurdly low interest rates, this is still an interesting position to try to gain from since rates could rise a long way but they could hardly fall much further, leading to an asymmetry of outcomes, but timing is key and we do not believe the time is right at the moment. Overall, the credit portfolio has contributed to the return, but we have a bond in Lebara (a mobile network operator active in several European markets) that has traded very weakly in the wake of doubts about its reporting. There is great suspicion about the management, and this bond is now trading at a price of 50-60. We still have remaining exposure to this as we believe the pricing more-than well reflects the risks in its operations.

The total equity portfolio consists of 55 unique names on the long side and 30 on the short side, plus hedges in the form of equity indexes and stock index options. Net exposure, which means the proportion of the portfolio exposed to equities, has been at most 15 percent during the year and is currently 6 percent. As a whole, the equity portfolio has had a negative trend during the year. The stock selection takes place on the basis of company-specific assessments. The performance of some of our positions has been unsuccessful this year. We have adjusted our positions in some cases, but for most of them we still see attractive return potential. Although the stock selection is individual, there are a few common denominators. One of these is that many of the holdings are value-oriented inexpensive shares that performed weakly during the spring and summer, when growth expectations were adjusted downward and interest rates fell in their wake.

Above all, our exposures to the commodities sector in general and, in particular, energy had a negative impact on the fund's returns. The fund's exposure to oil service companies made a sharply positive contribution until mid-May, but these have since been weak. These had very negative performance in October. The fund still has exposure, and the major threat to these companies is significantly weaker demand on the back of an economic slowdown, which the market has been increasingly pricing in as a higher probability this autumn. We have chosen to reduce our exposure to energy-related sectors.

Outlook

A low probability of recession remains our principal growth scenario, although the stock market trend of the past month is pricing in a much higher probability of recession than we have anticipated. The main reason for the low probability of a recession is that both monetary and fiscal policies are expansionary overall for the global economy. We should expect less expansionary monetary policy, but the pace of change is frustratingly slow, especially outside of the United States. Although valuations of financial assets are generally high, our best guess is that the sluggish economic recovery since 2009 will continue, with some hurdles along the way. One interesting observation is that, despite the sharp fall in stock markets during October, US 10-year yields rose. In addition, 2018 is turning into one of the weakest years for active management in a long time. A partial explanation for the weak performance of active management is that "cheap" companies have been very weak in comparison to "expensive" ones. Like many active managers, we seek to identify under-priced companies to buy and over-priced companies to sell. Eugene Fama and Kenneth French received the Nobel Prize in 2013, in part for their academic studies showing that the market is not efficient and that low-valued stocks yield higher returns over time than high-valued stocks. We still believe that our equity portfolio is well placed to provide a good risk-adjusted return, partly because of just this.

At sector level, we still like our exposure to the care sector, which is favoured by demographics and has structural growth not reflected in today's equity valuations. The portfolio also has a number of restructuring cases/value cases such as the holdings in NCC, Pandora and Wallenius. The short side is still dominated by companies with valuations that are too high relative to our assessment of future growth. For some of these companies, we also see a potential trigger as we believe a number them will find it difficult to address higher costs through higher prices for their products.

In summary, we see Catella Hedgefond as a comprehensive choice for investors who want a good risk-adjusted return through exposure to the Nordic capital market, irrespective of whether they are looking for exposure to equities or fixed income. The fund has a low correlation with the market and therefore has the ability to generate returns regardless of stock market performance. A good basic investment that complements other higher risk funds in a portfolio.