It was only a month or so ago that positive figures were released showing unemployment in the EU and the US was lower than for many years, and the stock market sentiment for 2020 remained upbeat. Few people regarded the coronavirus, which had already impacted China, as a major threat to the market. The uncertainty today is extremely high, to say the least, and the consequences of the coronavirus are difficult to exaggerate.

We are now in the midst of an extremely turbulent and uncertain period. The virus has had major humanitarian consequences, and places healthcare systems in an extraordinarily stressed situation worldwide. The virus has reminded us of black swans, and of the risk of owning shares and other risk assets. All assets are down, and continue to fall in price.

Central banks and governments around the world are launching crisis package after crisis package. What can people do with their investment portfolio when all assets, except cash, are fluctuating wildly?

Sometimes it is worth remembering and thinking about what the objectives of your investment portfolio are. The most important thing for creating a good long-term investment is to build your investment portfolio based on your needs and goals. This is the basis for all savings and investments, both for you as an investor and for those who work with investment advice. At Catella Fonder, we have in recent years advocated that people develop their portfolio to include not just building blocks like shares and bonds, but also more asset classes that create a better mix and risk-adjusted return over time. Not because these building blocks are risk-free, but because they contribute to the return over time in ways other than the traditional assets of stocks and bonds.

In the midst of the turmoil, it is also worth reminding ourselves that most of us are long-term in our investments, and that it is unfortunately difficult to time the ups and downs of the stock market. This means that the importance of having built your portfolio based on your own investment horizon and risk level is crucial.

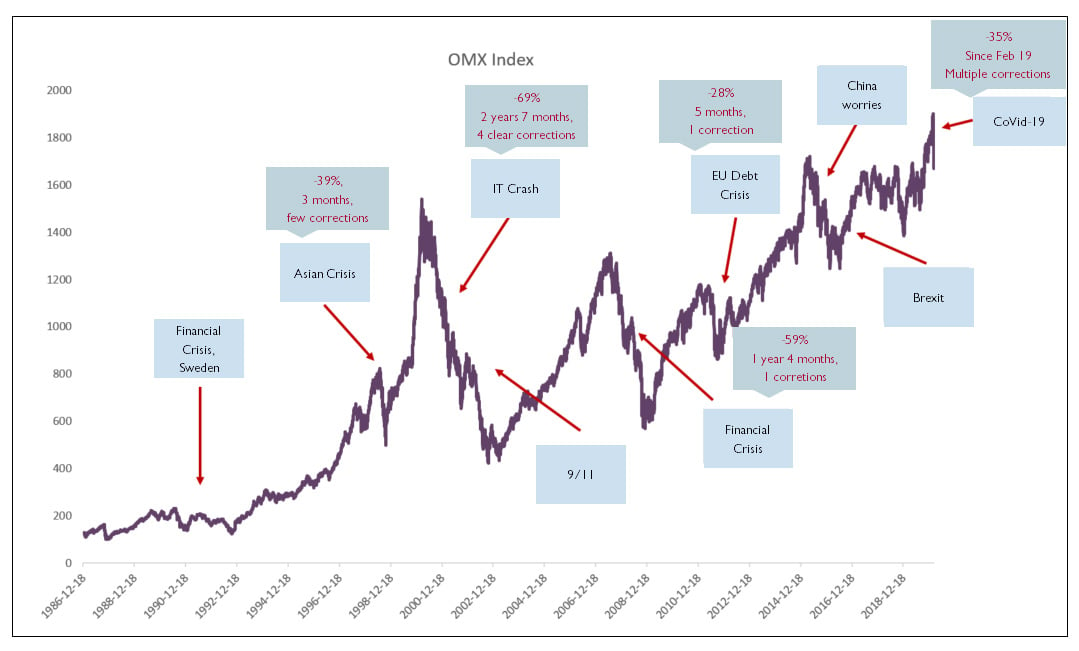

It is also worth looking to history, because what we are in the middle of right now has happened before. Not Covid-19 and the current crisis, but crisis behaviour. Of course, none of us know exactly how and when things will improve, but I think most of us believe, and know, that things will indeed get better, even though we are in the middle of the crisis right now. None of us has the answer to when this will turn around, and all we can do is ensure that our portfolio is well adapted to our own needs and investment horizon.

Back to the portfolio

The important thing is to make sure you have a portfolio in which different components contribute or protect each other at different times. Do not put all your eggs in one basket. Right now, in these history-making times of extremely rapid and sharp stock market decline, however, many assets tend to correlate with each other. During minor corrections, credit markets and corporate bonds are usually able to endure relatively well. But this time even the credit markets have been hit hard, and the shortage of liquidity as buyers stay away is evident. Spreads between what sellers are asking and what buyers are prepared to pay are very wide right now, which has even dragged down corporate bonds. We have long argued that perhaps the most important asset that has historically worked best as protection in a portfolio can no longer contribute in the same way. What we are referring to is mainly long-term bonds. These have previously been a good building block in a portfolio alongside shares. At times when the stock market has been shaky, central banks have in turn lowered interest rates and investors have bought bonds. This has traditionally pushed down interest rates and investments in bonds have therefore provided a good return. However, the situation is different now. Long-term bonds are trading with a negative yield and could clearly fall even further, but the return will not be the same as when interest rates were higher than they are today.

By building a portfolio with different asset classes, some risks are diversified away. When there is great uncertainty and many people are panicking, investors must not forget to try to position themselves for the future and return to the original intention of their investments and goals. Again, nobody knows when this crisis will come to an end and we can once again look forward to better growth and a good climate in the financial markets. But what we at Catella Fonder know is that there are many good and talented advisors who are happy to help you as a saver and investor. Advisors at banks, insurance companies, insurance brokers and others have one goal in common: To help you, their client, to find a good mix of assets that will enable you to achieve your investment goals, especially during a crisis like this. At Catella Fonder we are doing everything to ensure that our funds will emerge from this crisis in a good way.

Take good care of yourself and your investment portfolios!

Below is a graph as visual reminder of stock market crises that we have navigated in the past 30 years or so.

When things are at their most difficult, it is time to look at the long-term chart

Source: Bloomberg OMX (March 16, 2020)

We at Catella Fonder are of course available by phone or email if you have any questions / concerns.

Read: Two weeks into March 2020 – at the epicentre of Covid-19!