Catella’s latest European Residential Vision 2024 research report concludes that the acceleration in global warming is building-up pressure on residential real estate investors to integrate fundamental ‘climate finance’ strategies into their portfolios if they are to avoid the risks of a stagnation in values and being left holding stranded assets.

Climate finance, in the ‘mitigation’ and ‘adaptation’ structuring of investment portfolios, is becoming as critical to future returns as the level of interest rates, but with the key difference that these costs can be managed, Catella noted.

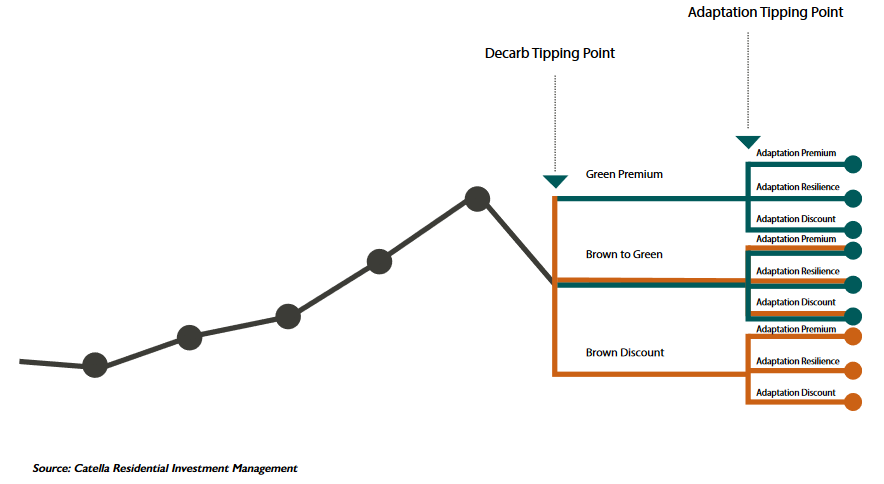

Residential portfolios will increasingly diverge in multiplying ‘Epsilon,’ or a Greek letter ‘E’-shape, trifurcation of valuation pathways from first decarbonisation, and then adaptation ‘tipping points,’ defined by ‘brown discounts’ and ‘green premiums,’ that will evolve into a new hierarchy framed by the relative resilience of assets to the growing physical risks of climate change (Fig. 1).

Xavier Jongen, Managing Director, Catella European Residential Investment, said: “Residential real estate is the source of around a third of total global greenhouse gas emissions and sits at the epicentre of the great challenges of climate change and societal inequality. But it is not widely understood by investors that integrating climate finance into your residential investment strategies is just as relevant for your future returns as interest rates. The delay in adopting a climate mitigation and adaptation financial mechanism is building up in accumulating levels of portfolio mispricing as global warming accelerates. The good news is that the climate cost machine has a logic of its own and you can control it.”

A climate mitigation strategy encompasses pricing the costs of the decarbonisation of assets in portfolios to meet increasingly strenuous sustainability regulations and the EU’s Green Deal interim target of achieving a 55% emissions reduction by 2030 on the road to a net carbon neutral economy by 2050. Mitigating CO2, for example by placing photovoltaic panels on assets, is the cheapest greening strategy as it benefits from a substitution effect and there should not be an additional cost. Mitigation also has a multiplier effect on all the other climate costs, because the earlier/later we mitigate and green the economy, the less/more we will pay for the other cost categories: adaptation, damages, and the ultimate clean-up costs.

Climate adaptation involves adjusting natural or human systems to reduce the vulnerability of social, economic and environmental assets to the impacts of global warming. They include for example, redesigning houses to make them less prone to flooding and high summer temperatures, relocation of companies, or dwellings, or even entire cities. In a scenario of a 2oC global temperature rise, total investment needs are estimated at around EUR 80 billion to EUR 120 billion per year for the EU and UK and to EUR 175 billion to EUR 200 billion with an increase of 3oC to 4oC.

Exhibit1: The Epsilon climate mitigation and adaptation valuation pathways

Xavier Jongen, concluded: “Mitigation through decarbonisation is financially the rational thing to do as it enhances income, strengthens energy security, avoids paying carbon taxes and most crucially, it lowers decarbonisation costs and avoids future value destruction. Institutional investors are, next to the State, the main stakeholders to get us into the ‘Green Growth World.’ Pension funds could, for instance, set targets on minimum amounts per year spend on decarbonizing assets in their assets to maximise their mitigation strategies. In a slightly more daring approach, one could link this to the performance fees of investment managers.”

Read more information about the Catella European Residential Vision Report here

About Catella Residential Investment Management GmbH (CRIM)

Catella launched its first European residential property fund in 2007. The team also launched the first specialized pan-European student housing fund in 2013. CRIM is a subsidiary of the Stockholm-based Catella AB Group and its residential property business includes portfolio management advice, acquisitions and disposals as well as asset management. CRIM manages and advises several funds and mandates with assets under management of over €7bn in ten European countries.

For more information, please contact:

Catella Residential Investment Management GmbH

Stine Zöchling

Head of Marketing and PR European Residential

Office: +49 (0)30 887 285 29 76

Mobile: +49 (0)151 544 51 005

stine.zoechling[ at ]catella-residential.com

Disclaimer:

This is a marketing release. It is for information purposes only and does not constitute investment advice, an investment recommendation, an offer or an invitation to buy or sell investment products. The information is not suitable for making a concrete investment decision on its basis. It does not contain any legal or tax advice. The provision of the information does not create any contractual obligation or any other liability towards the recipient or third parties. Shares may only be purchased on the basis of the currently valid Terms and Conditions of Investment in conjunction with the currently valid Sales Prospectus.